So your new to Medicare and feeling a little lost?

Not to worry. This will help clear up the confusion.

This article has two parts. Part one will address getting enrolled into Medicare. Part two will explain how Medicare works once your enrolled. If you have already enrolled, feel free to skip ahead to part two. Now, rather than me droning on like a robotic lawyer, I believe a quick Q&A works best for this part one. Let’s get to it.

Part One

What is Medicare?

Medicare is a federal health insurance program for people who are 65 or older, people with certain disabilities, and people with end-stage renal disease. For the scope of this series we are going to focus on people who are 65 or older. If you are disabled or have end-stage renal disease call us for more details.

When can you begin the enrollment process?

Medicare’s “Initial Enrollment Period” lasts 7 months. It begins 3 months prior to your birth “month”, your birth “month”, and the 3 months that follow. This is a very important time that you want to pay special attention to. Not everyone has to enroll at this time but you want to make sure you are one of them. More on this to come.

Who needs to enroll?

If you are retired or retiring you will likely want to enroll. If you are already retired and collecting Social Security or Railroad Retirement Board (RRB) benefits you will be automatically enrolled in Medicare Parts A & B and any premiums will be automatically deducted from your benefits check. We will get to the different “Parts” of Medicare and their costs shortly. Your Part A & B will start the first day of the month you turn 65. Note: If your birthday is on the first day of the month, Parts A & B will start the first day of the month prior.

Now, let’s say you are planning to retire when you turn 65, you will have a bit of homework. You will first want to decide if you want to begin collecting you retirement checks or defer them for later. If you decide you want to begin collecting, you can do this either by calling your local Social Security office or apply online at ssa.gov. This is how you will apply to begin your Medicare Parts A & B as well. Not to worry, it’s as easy as applying for a credit card. Note: If you worked for a railroad, contact the RRB.

Who does NOT need to enroll in Medicare?

The most common situation where you may want to defer starting Medicare is when you have “credible coverage”(coverage equal to that of Medicare) of some other form, typically through an employer. If you work for a small company of 20 or less you may still need to begin your Medicare.

If you are with out “credible coverage” and you miss your “Initial Enrollment Period”, you will have to wait until Medicare’s “General Enrollment Period”(Jan. 1st – Mar 31st) to begin your enrollment and your coverage will not begin until July 1st. You also will likely be subject to a penalty. Note: You may qualify for a “Special Enrollment Period”, to see if you qualify

What if I have VA, TRICARE, or CHAMPVA benefits?

VA benefits are not considered “credible coverage” for satisfying the “medical” parts of Medicare. Although, it is considered “credible coverage” for “medications” and does eliminate that penalty. This is beyond the scope of this article. Call if you have questions.

TRICARE recipients will need to enroll in Medicare parts A & B once first eligible to keep their TRICARE. Active duty service members and their family do NOT need to enroll in part B. If you have CHAMPVA coverage, you must enroll in Part A & B to keep it.

Is an ACA, aka Obamacare, plan “credible coverage”?

No and once you become eligible for Medicare you no longer qualify for a subsidy and will have to pay full price. Generally, these plans are more expensive and have inferior coverage compared to Medicare.

Should I get Medicare if I have Medicaid?

Yes, Medicaid may be able to help pay your Medicare out-of-pocket costs (like premiums, deductibles, coinsurance, and copayments). You also may qualify for a “Dual-Eligible” Medicare Advantage plan that may offer many extra benefits not covered by Medicare. Call for more information.

Part Two

Now, let’s get into how Medicare works and it’s costs. Medicare is broken down into four parts.

What are the different parts of Medicare and their cost?

Part A (Hospital): Most people will qualify for “premium-free” Part A. To qualify you or your spouse need to have worked and paid Medicare taxes for at least 10 years.

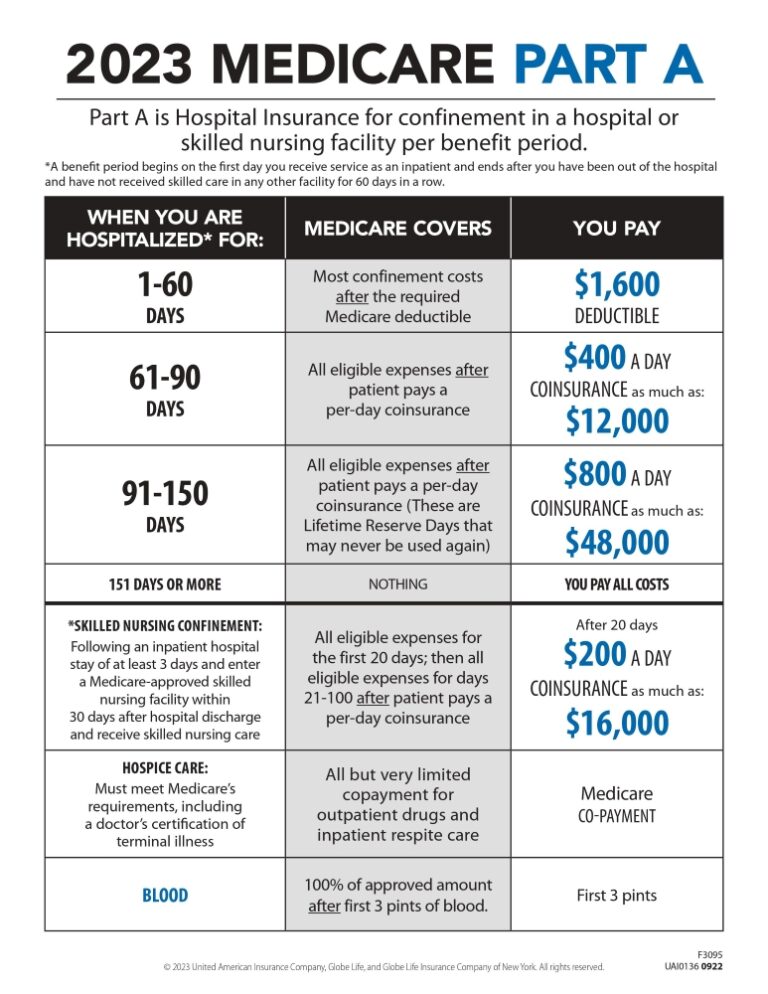

Part A will cover you in the event you are admitted to the “Hospital”. Any surgeries, x-rays, medical equipment, room and board, etc. will be covered by Part A during this time. Now, for a bit of bad news. Part A has deductibles and copays. The deductible is set by the federal government each year and for 2023 it’s $1600. Once the deductible is met, Medicare covers you days 1-60. Days 61-150, Medicare will cover you after but has a daily copay, see chart below. After day 150, Medicare stops paying. Part A also includes coverage for skilled nursing and hospice care. Note: The deductible is NOT an annual deductible. Once you have been 60 days without skilled or hospital care, the benefits reset and you could have to cover the deductible again. A “Medicare Supplements” can protect you from this.

Part B (Medical): The Part B premium is set by the government each year. As of 2023, it is $164.90 per month. Individuals and couples with high income(s), may have to pay more. For 2023, Individuals with income over $97,000 or couples filing jointly over $194,000 per year. Call us if this is your situation, we may be able to help.

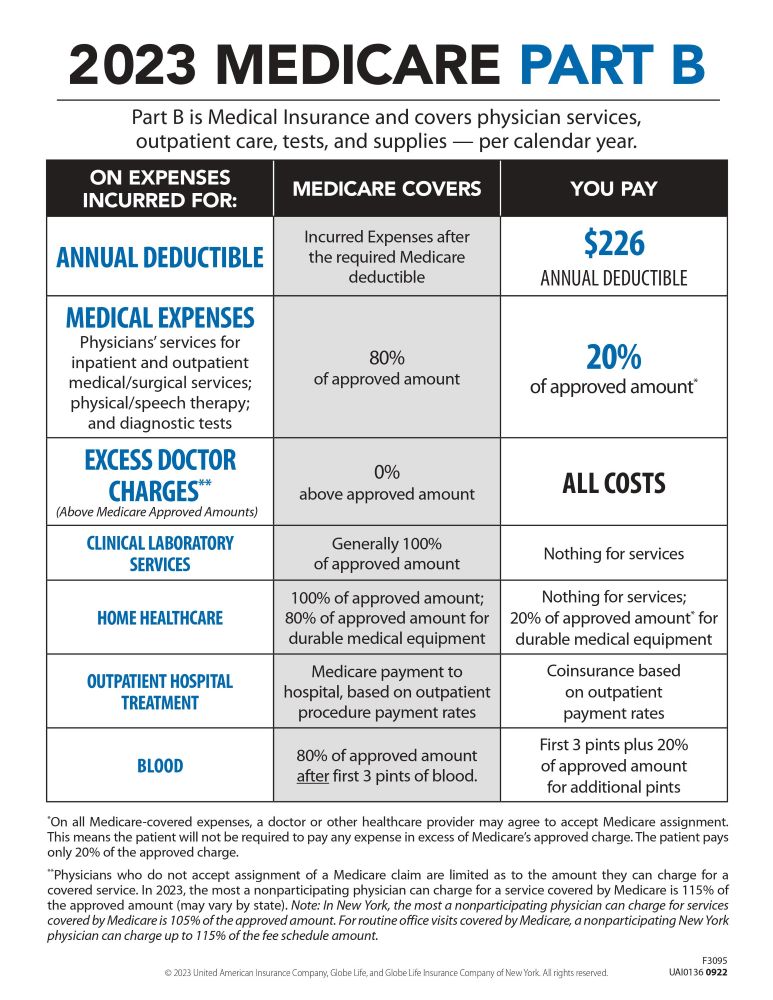

Part B covers you for “outpatient” medical care. If you are receiving medical care and have not been admitted to the hospital, it likely is covered by Part B. Some examples are doctor or specialist visits, blood work, outpatient surgeries, ambulance, urgent care, etc. Medicare will cover 80% of the cost of these service after you have met your “annual” Part B deductible, $226 for 2023.

For example, lets say in January you see your primary doctor and he charges $226 for your visit. You would pay that out of pocket. At this point your deductible has been met for the year. Then let’s say in February you have an outpatient surgery that costs $10,000, Medicare pays $8,000(80%) and you pay $2,000(20%), see chart below. Simple enough, right? Note: There is no limit to your potential out-of-pocket costs and the deductible resets every year on January 1st. Again, A Medicare Supplement or Medicare Advantage plan may help.

Parts A & B are relatively straight forward in regards to the amount you will pay and it covers a broad range of service. You can also receive care anywhere in the U.S. as long as the provider accepts Medicare.

Part C (Medicare Advantage plans): In short, Part C is another name for a Medicare Advantage plan. These plans are managed by private insurance companies. Medicare pays these companies to provide you with your Medicare benefits. Some of the pros are many of these plans will have a $0 premium(you still have to pay your Part B premium), many include drug coverage, extra benefits such as dental, vision, and hearing, and they are bundled into one plan. Some common pitfalls are a limited network of doctors and hospitals, the need for referrals and pre-authorization, co-pays and co-insurance, and unpredictable medical costs.

Note: If you are considering a Medicare Advantage plan you should also learn about Medicare Supplements, aka “Medigap”. We discuss this in great detail in our article, “5 reasons to choose a Medicare Supplement”.

Part D (Stand-alone Drug plans): Part D plans are regulated by the federal government but purchase through private insurance companies. These plans generally have a monthly premium ranging anywhere from under $10 for over $70 per month. Choosing will often be dictated by the medications you take.

For example, if you are taking no medication, we would recommend a cheap plan so you have coverage and avoid possible future penalty. Things can get a bit tricky if you are on brand name medications. These medications could cause you to have to meet a deductible and may cause other perils such as the “donut hole”. If you are in this situation, please call us. We have helped many people in difficult situation such as these.

You can change plans during Medicare’s “Annual Enrollment Period”(Oct. 15th – Dec. 7th) so you are never married to a plan forever. These plans tend to change a bit each year, as may your medication needs. For that reason, we perform an “annual review” with all of our clients to discuss any changes that may need to be addressed.

I hope you found this article helpful. If you have any questions, please give us a call. We are happy to help.

Check out “5 reasons to choose a Medicare Supplement”.

Medicare Supplement Quotes

By clicking “Submit” you are acknowledging that you may be contacted by a licensed agent via phone, SMS message and email. You will only be contacted by Medicare One for All. You may opt out of SMS messages by entering NO in the message section above.