What is the right Medigap plan for you?

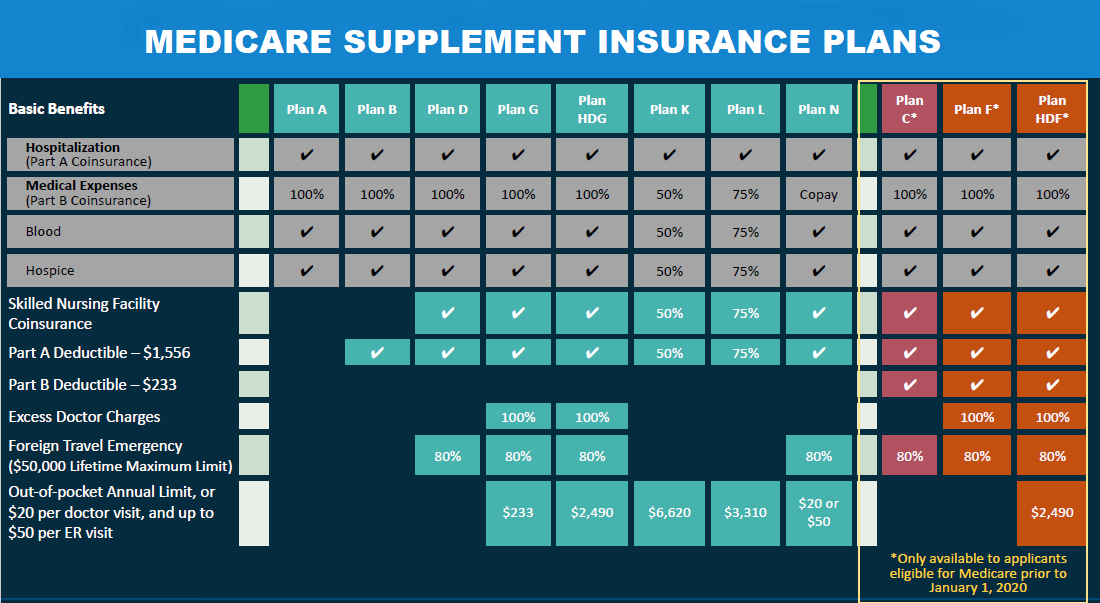

While Medicare covers many medical expenses, there are some out-of-pocket costs that beneficiaries may be responsible for, such as deductibles, copayments, and coinsurance. To help cover these costs, beneficiaries may choose to enroll in a Medicare Supplement (also known as Medigap) plan.

There are several different Medigap plans available, each with its own set of benefits and costs. In this article, we’ll take a closer look at the differences between the most popular Medigap plans, plans F, G, N, and HDG.

*Information as of 1/1/2022

Medigap Plan F

Medigap Plan F is one of the most comprehensive Medigap plans available. It covers all of the out-of-pocket costs that Original Medicare does not cover, including the Medicare Part A and Part B deductibles, copayments, and coinsurance. Plan F also covers excess charges, which are charges that exceed the Medicare-approved amount for a given service.

While Plan F provides comprehensive coverage, it is also the most expensive Medigap plan. In addition, it is no longer available to new Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020.

Conclusion: We generally don’t recommend Plan F as rates have risen drastically since the younger, healthier individuals are no longer eligible to enroll. Plan G is often a more affordable option.

Medigap Plan G

Medigap Plan G is similar to Plan F in that it provides comprehensive coverage for out-of-pocket costs. However, it does not cover the Medicare Part B deductible($226 in 2023), which beneficiaries must pay before Medicare coverage begins. Once the deductible is met, Plan G covers all remaining out-of-pocket costs, including excess charges.

Plan G is the most popular Medigap plan, and it is available to all Medicare beneficiaries, regardless of when they became eligible for Medicare.

Conclusion: We highly recommend Plan G as it has comprehensive coverage, a reasonable rate, a low annual deductible, and no copays. That being said, some healthier individual may benefit from the lower premiums of Plan N.

Medigap Plan N

Medigap Plan N is a lower-cost option that covers many out-of-pocket costs, but with some cost-sharing. Plan N, like it’s counterpart Plan G, does not cover the Part B deductible. It also requires beneficiaries to pay a copayment of up to $20 for doctor or specialist visits and up to $50 for emergency room visits. Also, Plan N does not cover excess charges in most states.

Plan N may be a good choice for those who are willing to pay some out-of-pocket costs in exchange for lower premiums. However, it may not be the best option for those who anticipate needing frequent medical care.

Conclusion: We recommend Plan N for healthier individuals who seldom have doctor visits and their savings in premiums outweigh their cost in copays. Ultimately, excess charges are a possibility but are relatively uncommon as most doctors choose not to charge them.

Overall Plan F, G, and N are the 3 most popular Medigap plans. They are ideal for individual who want to protect themselves from unexpected medical cost while having the flexibility to see any Medicare provider anywhere in the country.

Now let’s talk about a newer Medigap plan that is starting to gain popularity.

Medigap Plan HDG

Medigap Plan HDG, or High Deductible Plan G, doesn’t work like traditional high-deductible health plans and offers much lower premiums than the plans we mentioned earlier. It can save healthy individuals a significant amount of money over the years.

As with any Medigap plan, Original Medicare covers 80% of your medical expenses. With Plan HDG, you pay the other 20% until the deductible is met($2,700 in 2023). After the deductible is met, the plan covers the same as a standard plan G.

For example, let’s say something catastrophic happens and you incur $100,000 medical bills. Medicare pays 80% or $80,000, you pay the other 20% up to the deductible or $2,700, and the Plan HDG pays the remainder or $17,300 as well as any other charges for the rest of the calendar year.

Conclusion: We recommend Plan HDG for healthy individuals who rarely need medical care and have a budget that can endure a significant medical bill. These are most popular in states with expensive Medigap plans as the saving are most attractive. However, it’s important to be cautious when considering this plan and carefully review your needs and budget.

In conclusion, each of the Medigap plans F, G, N and HDG offer different levels of coverage and cost-sharing. It’s important for beneficiaries to carefully consider their healthcare needs and budget when choosing a Medigap plan, and to compare the costs and benefits of each plan before making a decision.

Medicare Supplement Quotes

By clicking “Submit” you are acknowledging that you may be contacted by a licensed agent via phone, SMS message and email. You will only be contacted by Medicare One for All. You may opt out of SMS messages by entering NO in the message section above.